When To Bring In A Public Adjuster For Your Condo Association’s Insurance Claim

You’re responsible for receiving an insurance settlement for your condominium association, but you don’t have to shoulder that responsibility alone. You can secure the comfort, safety, and financial wherewithal of your condo’s residents by bringing in a public adjuster to ensure a fair insurance claim settlement. This guide breaks down the very concept of a […]

Can A Public Adjuster Reopen My Denied Claim In Naples? Here’s What You Need To Know

Claim denials aren’t exactly rare in Naples, but that doesn’t mean they’re not a pain to deal with, either. When that compensation paycheck could make a big difference in getting your life back, don’t ever settle. Try again and hire your own team of insurance professionals! Find out how a public adjuster in Naples can […]

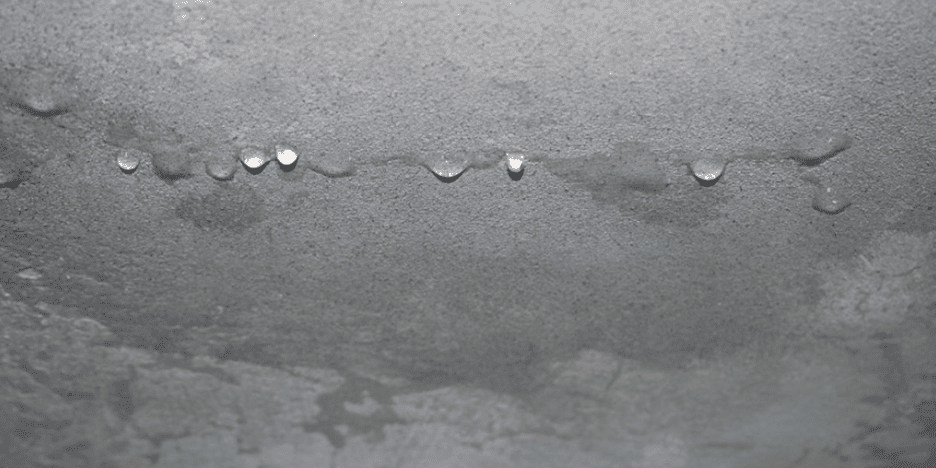

Water Damage In Your Nashville Home? Don’t Let Your Insurance Company Lowball You

Without insider knowledge, it can feel impossible to tell if you’re getting a fair amount for your water damage claim in Nashville. If you have even the slightest inkling of your insurer lowballing you, hold off on signing that settlement agreement! Take a moment to learn more about the process and hire your trusted team […]

The Role Of A Public Adjuster In Protecting Your HOA’s Reserve Funds During Insurance Claims

HOA reserve funds don’t just appear overnight. They grow over a period of time and are earmarked for various future maintenance projects. So, it is vital that every dollar be preserved whenever possible. That might be a difficult task in Florida, where mother nature is very active causing natural disasters. Why would you use your […]

Safety First: How Public Adjusters Help HOAs Protect Residents

Your residents always come first. That’s what you truly believe as a responsible HOA manager, but just how do you ensure the security of the neighborhood? With expert help, that’s how. Property owners and managers can rely on their local team of reputable public adjusters to protect residents with efficient insurance claim handling. Find out […]

Pre-Existing Damage: Why Your Claim Could Be Denied If Insurers Think The Damage Isn’t New

Your property endured a bit of an accident, and so you submitted an insurance claim (as you should). The place already needed some work done after a prior incident, but you never had the time to fix it up. Did you think that you could take your new settlement check and repair everything all at […]

Denied Or Underpaid Water Damage Claim After A Storm? Here’s What You Can Do

Storms are one of the most difficult struggles to recover from. You have much on your plate already as a property owner in Orlando, so it can slow down your agenda when your insurance company denies your claim or doesn’t give you nearly as much as you need for recovery. The important thing is to […]

Different Types Of Adjusters: Understanding Costs & Comparing Your Options

Property insurance is a big deal, and that’s why there are so many different types of adjusters who specialize in damage claims in Florida. While they all reside in the insurance industry, you could be seeing a difference in settlement amounts by hiring the right (or wrong) type of expert. This guide compares the various […]

2025 Hurricane Season In Tampa Bay: Predicted Activity & Resource Guide

We’ve had a good number of hurricanes hurling their way towards Florida this year. Although we wish for nothing but your safety, it’s better to go into the season fully prepared and ready for anything. Everything you need to know is right below. What to expect, all the resources you need, and where to go […]

Altieri Insurance Consultants Adds New VP to Leadership Team

Altieri Insurance Consultants is pleased to announce that Jordan Mulbarger has joined their public adjusting firm, becoming part of the leadership team as a new Vice President. Mr Mulbarger will be based out of the company’s corporate headquarters in Tampa Florida and is expected to lead various adjusting teams to different regions of need throughout […]